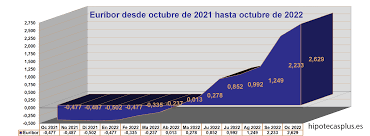

Euribor-sube, the interest rate used to set mortgage rates in Spain, has gone up again. In January, the Euribor reached 1.550%, which is higher than the 1.526% from December. This means that the interest rates on many mortgages will be higher.

For anyone with a mortgage, this rise in can mean higher monthly payments. If you have a mortgage of 120,000 Euros over 20 years, your monthly payment could go up by about 25 Euros. Let’s take a closer look at what this means and how it affects you.

What Is Euribor-Sube and Why Is It Important?

It is a very important interest rate in Europe. It stands for the Euro Interbank Offered Rate. Banks use it to set the interest rates on loans and mortgages. When goes up, it means borrowing money becomes more expensive.

This rate is important because it affects how much people pay for their mortgages. If you have a loan, you might see your payments go up when rises. It’s like a signal that tells banks how much to charge for loans.

Knowing about helps you plan better for your finances. If you’re thinking about getting a mortgage or already have one, it’s good to keep an eye on this rate. It can help you understand why your payments might change.

How Does Euribor-Sube Affect Your Mortgage?

When goes up, your mortgage payments can go up too. This is because many banks use this rate to set their mortgage rates. If rises, they might charge you more interest on your loan.

A higher means higher monthly payments. For example, if you have a mortgage of 120,000 Euros over 20 years, your payment could increase by about 25 Euros a month. This can add up over time and affect your budget.

It’s important to know how affects your mortgage so you can plan ahead. If you expect the rate to rise, you might want to save a little extra money each month. This way, you won’t be caught off guard by higher payments.

January’s Euribor-Sube Increase: What It Means for Homeowners

In January, went up to 1.550%. This was higher than December’s rate of 1.526%. For homeowners, this increase means higher mortgage payments. If your mortgage is due for review, you might see your payments go up soon.

This increase is not huge, but it can still make a difference. A small rise in can mean paying more each month. For some people, this extra cost can be challenging, especially if you are on a tight budget.

Understanding why increased can help you prepare. Sometimes, rates go up because of changes in the economy. Knowing the reasons behind the rise can help you make better financial decisions.

Why Did Euribor-Sube Rise to 1.550% in January?

It rose to 1.550% in January because of various factors. One reason is that banks expect higher interest rates in the future. When banks think rates will go up, they start charging more now.

Another reason is inflation. When prices rise, the cost of borrowing money can go up too. Banks increase to protect themselves against inflation. This means they charge more interest on loans and mortgages.

Economic conditions also play a role. If the economy is doing well, banks might raise rates. They do this to keep the economy from overheating. By raising, they try to balance economic growth and stability.

Euribor-Sube Trends: What to Expect in the Coming Months

Euribor-sube can change from month to month. In the coming months, it might go up or down. Many experts believe that will continue to rise slowly. This is because of ongoing economic changes and inflation.

If keeps going up, mortgage payments will increase too. Homeowners should prepare for this possibility. Saving extra money each month can help you manage higher payments. It’s a good idea to stay informed about rate changes.

Watching trends can help you make better financial decisions. Knowing what to expect helps you plan your budget. If you think rates will rise, you might decide to pay off your mortgage faster or refinance to a fixed-rate loan.

How to Prepare for Higher Euribor-Sube Rates

Preparing for higher rates can help you manage your finances better. One way to prepare is by saving more money each month. This extra savings can cover the higher mortgage payments if the rate goes up.

Another way to prepare is to check your mortgage terms. Some mortgages have fixed rates, which don’t change. If you have a variable rate mortgage, you might want to consider switching to a fixed rate to avoid surprises.

Talking to a financial advisor can also help. They can give you advice on how to manage your mortgage with rising rates. Planning ahead can make it easier to handle changes in and keep your budget on track.

Understanding the Impact of Euribor-Sube on Monthly Payments

has a big impact on monthly mortgage payments. When this rate goes up, banks charge more interest. This means your monthly payments will increase. It’s important to understand how this works so you can plan your finances.

For example, if rises by 0.1%, your mortgage payment might go up by a few Euros each month. Over a year, this adds up. Knowing this helps you prepare for higher costs and avoid financial stress.

Keeping track of changes can help you stay informed. By knowing when the rate goes up or down, you can adjust your budget accordingly. This way, you won’t be surprised by higher payments.

Euribor-Sube vs. MIBOR: What’s the Difference?

It and MIBOR are both interest rates, but they are used differently. is used for setting mortgage rates in many European countries. MIBOR, or Madrid Interbank Offered Rate, was used in Spain before.

Euribor-sube is calculated using data from major European banks. It reflects the average interest rate for one-year loans. MIBOR was similar but was only used in Spain. Today, has mostly replaced MIBOR.

Understanding the difference helps you know which rate affects your mortgage. If you have an older mortgage, it might still use MIBOR. Newer mortgages use. Knowing which rate applies to you can help you track changes and manage your payments.

The History of Euribor-Sube: A Look Back

Euribor-sube has been around for many years. It was introduced in 1999 by the European Banking Federation. Before Euribor-sube, different countries had their own rates. Euribor-sube unified these rates across Europe.

Over the years, Euribor-sube has gone up and down. It reflects changes in the economy and banking practices. Understanding its history can give you a better idea of why it changes and how it affects you.

Looking back at Euribor-sube trends helps you see patterns. You can see when rates were high or low and what caused these changes. This knowledge can help you predict future changes and prepare for them.

How Banks Use Euribor-Sube to Set Mortgage Rates

Banks use Euribor-sube as a benchmark to set mortgage rates. When Euribor-sube goes up, banks increase their mortgage rates. This is because the cost of borrowing money has gone up for them too.

Euribor-sube helps banks determine how much interest to charge. It ensures that they make a profit while lending money. For homeowners, this means higher payments when Euribor-sube rises.

Understanding this process helps you see why your mortgage payments change. Knowing how banks use Euribor-sube can help you plan better. You can anticipate changes and adjust your budget accordingly.

Will Euribor-Sube Continue to Rise? Expert Predictions

Many experts predict that Euribor-sube will continue to rise. This is because of ongoing economic changes. Inflation and economic growth can push rates higher. Keeping an eye on expert predictions can help you stay informed.

If Euribor-sube keeps rising, mortgage payments will go up too. Homeowners should be prepared for this possibility. Saving extra money each month can help you manage higher payments.

Experts also suggest looking at long-term trends. Euribor-sube might go up and down over the years. Understanding these trends can help you make better financial decisions. Planning ahead can make it easier to handle changes in mortgage rates.

Tips for Managing Your Mortgage with Rising Euribor-Sube

Managing your mortgage with rising Euribor-sube can be challenging. One tip is to create a budget that includes higher payments. This way, you won’t be surprised by changes in your monthly costs.

Another tip is to consider refinancing your mortgage. Switching to a fixed-rate mortgage can help you avoid future rate increases. This gives you more stability and predictability in your payments.

Talking to your bank can also help. They might offer options to manage rising rates. Understanding your mortgage terms and exploring different strategies can make it easier to handle changes in Euribor-sube.

The Role of the European Banking Federation in Euribor-Sube

The European Banking Federation plays a key role in Euribor-sube. They calculate the rate using data from major European banks. This ensures that the rate is fair and reflects current market conditions.

The Federation collects data on interest rates for one-year loans. They use this data to set Euribor-sube. Their role is important because it ensures that the rate is accurate and reliable.

Understanding the role of the Federation helps you see why Euribor-sube changes. Knowing how the rate is calculated can give you confidence in its accuracy. This can help you plan better for changes in your mortgage payments.

How Euribor-Sube Affects the Spanish Housing Market

Euribor-sube has a big impact on the Spanish housing market. When the rate goes up, mortgage payments increase. This can affect how much people can afford to pay for homes.

Higher Euribor-sube rates can slow down the housing market. People might buy fewer homes because of higher costs. This can lead to lower prices and less activity in the market.

Conclusion

In summary, Euribor-sube plays a big role in setting mortgage rates. When Euribor-sube goes up, your monthly mortgage payments can also rise. This can affect your budget and how much you pay for your home. Keeping track of Euribor-sube helps you understand these changes and plan better for your finances.

If you see Euribor-sube rising, it’s a good idea to save a little extra money each month. This way, you’ll be prepared for higher payments. Staying informed and managing your mortgage wisely can help you handle any changes smoothly.