Jordan Meadow, a stockbroker from New York, NY, has been in the spotlight recently due to allegations surrounding his financial practices. Known for his work at firms like Spartan Capital Securities and Maxim Group, Jordan Meadow faces accusations of insider trading and accessing confidential information about mergers and acquisitions. These allegations, brought forth by the U.S. Securities and Exchange Commission (SEC), claim that Meadow made substantial profits through these activities, affecting both his clients and his own financial standing

The Background of Jordan Meadow

Jordan Meadow has a background that intertwines with the financial world of New York City. Born and raised in the bustling streets of Manhattan, Meadow began his career in finance early on, working at prominent firms such as Spartan Capital Securities and Maxim Group. His journey into the world of stockbroking started with a passion for numbers and a drive to succeed in the competitive field of investments.

From his early days as a financial advisor to his more recent activities, Jordan Meadow has navigated various roles within the industry. His career path has been marked by notable achievements and, more recently, by allegations that have brought him into the public eye.

Jordan Meadow’s Career Journey

Jordan Meadow’s career journey reflects a trajectory marked by both success and controversy. Starting as a stockbroker at Spartan Capital Securities, Meadow quickly made a name for himself with his sharp financial acumen and ability to navigate complex market dynamics. His tenure at Maxim Group further solidified his reputation as a savvy investor and trusted advisor to clients seeking to grow their portfolios.

Throughout his career, Meadow has been known for his strategic insights and proactive approach to investment management. However, recent developments, including allegations of insider trading, have cast a shadow over his professional legacy.

Inside Look at Jordan Meadow’s Current Status

Currently, Jordan Meadow faces a complex legal and regulatory landscape stemming from allegations of insider trading and unauthorized access to confidential information. These allegations, brought forth by the U.S. Securities and Exchange Commission (SEC), have put his career and reputation under scrutiny.

Despite these challenges, Meadow remains an influential figure in the financial community, with ongoing legal proceedings shaping his present status. Investors and industry professionals alike are closely monitoring developments surrounding his case, which could have significant implications for future regulatory practices.

Allegations Against Jordan Meadow: What You Need to Know

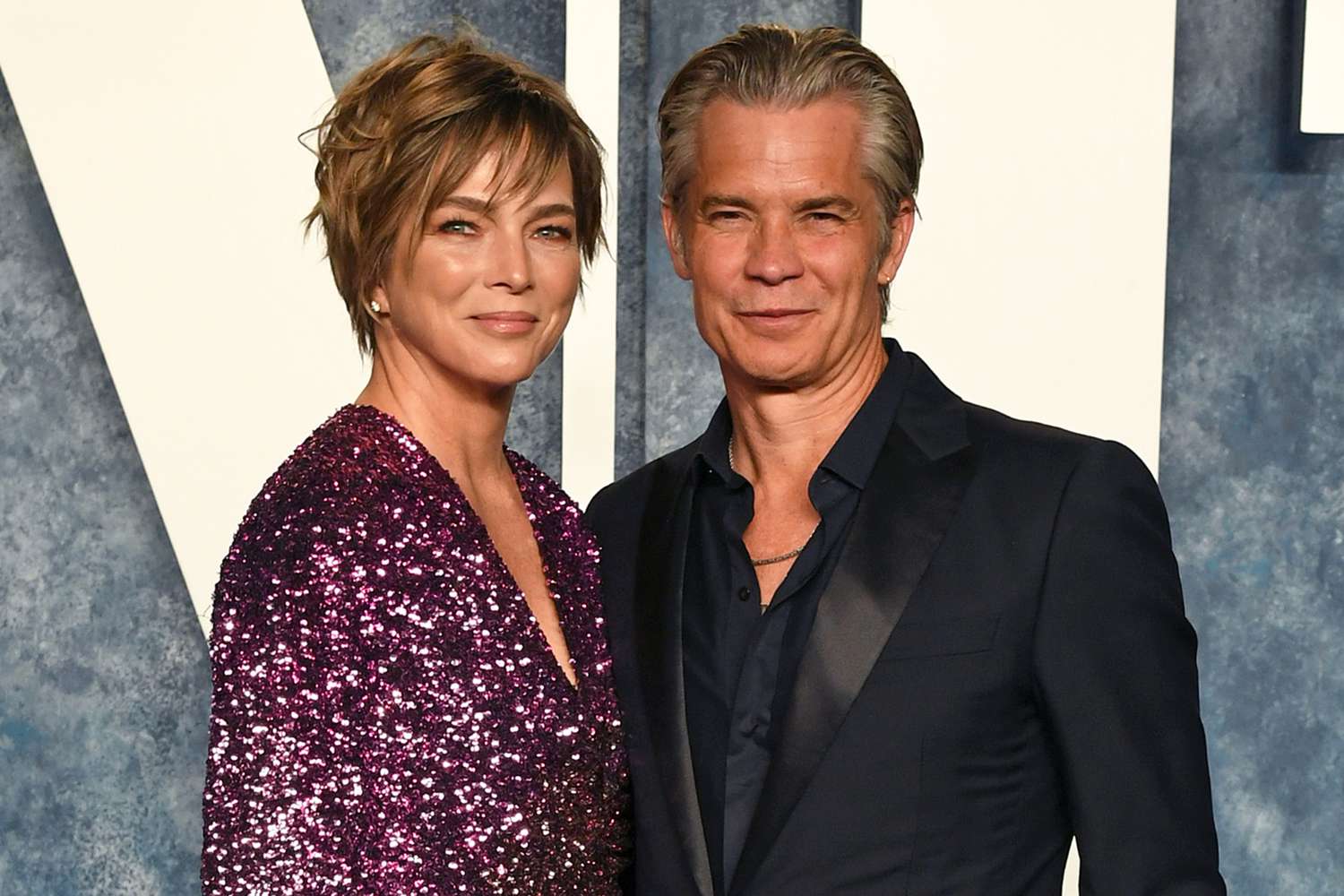

The allegations against Jordan Meadow are centered on accusations of insider trading and misuse of nonpublic information related to potential mergers and acquisitions. According to the SEC complaint, Meadow allegedly accessed confidential data through his girlfriend, who worked at a prominent investment bank in New York City.

These allegations suggest that Meadow used this privileged information to benefit financially, both for himself and his brokerage clients. The SEC’s complaint seeks substantial penalties, including financial disgorgement, civil fines, and restrictions on Meadow’s future involvement in public company governance.

Jordan Meadow’s Role as a Stock Broker

Jordan Meadow’s role as a stockbroker has been multifaceted, encompassing responsibilities ranging from client advisory services to strategic investment planning. Throughout his career, Meadow has leveraged his expertise to guide clients through volatile market conditions and capitalize on emerging investment opportunities.

As a trusted advisor, Meadow has built relationships based on transparency and diligence, providing tailored investment strategies to meet each client’s financial objectives. However, recent legal challenges have raised questions about Meadow’s adherence to ethical standards and regulatory compliance within the financial services industry.

Where is Jordan Meadow Located?

Jordan Meadow is primarily located in New York City, where he has been active in the financial sector for several years. His presence in the heart of Manhattan underscores his proximity to key financial markets and institutions, allowing him to stay abreast of market trends and regulatory developments.

New York City’s status as a global financial hub provides Meadow with access to a network of industry professionals, investors, and regulatory bodies. This geographical advantage has played a crucial role in shaping Meadow’s career trajectory and professional interactions within the financial services community.

Jordan Meadow’s Alias and CRD Number

Jordan Meadow is also known under his official alias within the financial industry. His CRD number, 6116538, uniquely identifies him within the Financial Industry Regulatory Authority (FINRA) database, which tracks the professional history and regulatory compliance of brokers and financial advisors.

Meadow’s alias and CRD number are essential for investors and regulatory authorities seeking to verify his professional credentials and track his career history. This information helps ensure transparency and accountability in Meadow’s interactions with clients and regulatory agencies.

Can Jordan Meadow Be Sued?

Jordan Meadow’s involvement in legal proceedings, particularly regarding allegations of insider trading and regulatory violations, raises questions about his potential liability and susceptibility to legal action. Investors and affected parties may explore legal avenues, including FINRA arbitration, to seek recourse for financial losses or damages resulting from Meadow’s alleged misconduct.

The possibility of litigation against Meadow hinges on the outcome of ongoing investigations and regulatory actions. Legal experts and securities attorneys can provide guidance on the feasibility and process of pursuing legal claims against Meadow based on specific circumstances and evidence.

Jordan Meadow’s Financial History: Liens and Judgments

Jordan Meadow’s financial history includes disclosures of outstanding judgments and liens, which are required to be reported under FINRA regulations. These financial matters can impact Meadow’s credibility and financial standing within the investment community, influencing investor confidence and regulatory scrutiny.

The disclosure of liens and judgments underscores the importance of transparency and accountability in Meadow’s financial disclosures. Investors and regulatory authorities may review these disclosures to assess Meadow’s financial responsibility and adherence to regulatory requirements.

Pending Investigations Involving Jordan Meadow

Jordan Meadow is currently the subject of multiple investigations, including inquiries by the U.S. Securities and Exchange Commission (SEC) and other regulatory agencies. These investigations focus on allegations of insider trading and unauthorized access to confidential information related to potential mergers and acquisitions.

The outcome of these investigations could have significant implications for Meadow’s career and regulatory standing within the financial services industry. Investors and industry stakeholders are closely monitoring developments to understand the potential impact on market integrity and regulatory oversight.

Understanding FINRA’s Role in Jordan Meadow’s Case

FINRA, the Financial Industry Regulatory Authority, plays a crucial role in overseeing the conduct and compliance of registered brokers like Jordan Meadow. FINRA’s regulatory framework sets standards for professional behavior, ethical practices, and investor protection within the securities industry.

In Meadow’s case, FINRA’s involvement includes monitoring compliance with regulatory requirements, investigating allegations of misconduct, and imposing sanctions or disciplinary actions when warranted. Investors and industry participants rely on FINRA’s oversight to uphold market integrity and safeguard investor interests.

SEC’s Complaint Against Jordan Meadow Explained

The U.S. Securities and Exchange Commission (SEC) has filed a formal complaint against Jordan Meadow, alleging violations of securities laws related to insider trading and misuse of confidential information. The SEC’s complaint outlines specific allegations that Meadow accessed nonpublic information through his girlfriend, who worked at a prominent investment bank in New York City.

According to the SEC, Meadow used this insider information to execute trades and provide investment advice to his brokerage clients, resulting in substantial financial gains. The complaint seeks legal remedies, including financial disgorgement, civil penalties, and restrictions on Meadow’s future activities within the securities industry.

Details of the Insider Trading Allegations

The insider trading allegations against Jordan Meadow involve accusations that he accessed confidential information about upcoming mergers and acquisitions through unauthorized means. According to regulatory filings, Meadow allegedly obtained this nonpublic information from his girlfriend, who had access to sensitive data at a leading New York-based investment bank.

Meadow is accused of using this privileged information to execute trades on behalf of his brokerage clients, resulting in significant financial gains and commissions. The allegations highlight the potential legal and ethical ramifications of insider trading within the financial services industry.

Jordan Meadow’s Trading Strategies Unveiled

Jordan Meadow’s trading strategies have been a topic of interest within the financial community, reflecting his approach to navigating volatile market conditions and capitalizing on investment opportunities. Meadow’s strategic insights and market analysis have informed his decision-making process as a stockbroker, aiming to maximize returns for his clients and brokerage firm.

However, recent allegations of insider trading have raised questions about the ethical boundaries of Meadow’s trading practices and compliance with securities regulations. Investors and industry observers are scrutinizing Meadow’s trading strategies and their alignment with legal and regulatory standards.

Jordan Meadow’s Impact on Brokerage Customers

Jordan Meadow’s role as a stockbroker has had a significant impact on his brokerage customers, who rely on his expertise and guidance in making investment decisions. Meadow’s recommendations and trading activities have influenced the financial outcomes of his clients, ranging from individual investors to institutional firms seeking portfolio growth and risk management strategies.

Recent allegations of insider trading have raised concerns among Meadow’s brokerage customers regarding the integrity of his financial advice and the potential implications for their investment portfolios. Investors are evaluating the impact of Meadow’s actions on their financial interests and exploring options for recourse or recovery of potential losses.

Legal Ramifications for Jordan Meadow

Jordan Meadow faces potential legal ramifications stemming from allegations of insider trading and violations of securities laws. The U.S. Securities and Exchange Commission (SEC) has initiated legal proceedings against Meadow, seeking remedies such as financial disgorgement, civil penalties, and restrictions on his future activities within the securities industry.

The outcome of these legal proceedings could impact Meadow’s professional reputation, regulatory standing, and financial liability. Investors, regulatory authorities, and legal experts are closely monitoring developments to assess the implications for market integrity and investor protection.

IRS Lien Against Jordan Meadow

Jordan Meadow’s financial history includes an IRS lien filed in Federal Court, indicating outstanding tax obligations amounting to $245,736. The lien, filed in January 2023, underscores Meadow’s financial responsibilities and obligations under federal tax laws.

The disclosure of an IRS lien is significant within the financial services industry, as it reflects on Meadow’s financial credibility and regulatory compliance. Investors and regulatory authorities may consider this financial disclosure when evaluating Meadow’s professional conduct and adherence to legal and financial obligations.

How Investors Can Recover Losses with Jordan Meadow

Investors who have suffered financial losses due to Jordan Meadow’s alleged misconduct may explore options for recovery through FINRA arbitration or legal action. FINRA arbitration provides a streamlined process for resolving disputes between investors and brokerage firms, including claims related to fraud, negligence, or unauthorized trading.

Legal experts and securities attorneys can assist investors in assessing the merits of their claims and pursuing compensation for investment losses attributable to Meadow’s actions. Recovery efforts may include seeking financial restitution, punitive damages, or other legal remedies available under securities laws and regulations.

Consulting with Bob Rex: What You Should Know

Bob Rex, a seasoned securities lawyer, offers expertise and guidance to investors affected by Jordan Meadow’s alleged misconduct. With offices in Boca Raton, FL, and Austin, TX, Rex provides nationwide representation to investors seeking to recover investment losses through FINRA arbitration or legal proceedings.

Consulting with Bob Rex allows investors to explore their legal rights and options for pursuing compensation in cases involving fraud, misrepresentation, or other forms of securities violations. Rex’s experience and advocacy ensure that investors receive comprehensive legal support in navigating complex financial disputes.

Options for Those Affected by Jordan Meadow’s Actions

Investors and brokerage customers affected by Jordan Meadow’s alleged actions have several options for recourse and recovery of investment losses. Consulting with securities attorneys and legal experts can provide guidance on the process of filing claims, gathering evidence, and pursuing compensation through FINRA arbitration or litigation.

Affected parties may seek restitution for financial losses, punitive damages, or other legal remedies available under securities laws and regulations. Exploring all available options allows investors to safeguard their financial interests and hold accountable those responsible for misconduct within the securities industry.

The Importance of SEC and FINRA Compliance

Compliance with SEC and FINRA regulations is essential for maintaining integrity and accountability within the securities industry. Jordan Meadow’s case highlights the importance of adhering to ethical standards, regulatory requirements, and disclosure obligations to protect investors and uphold market transparency.

SEC and FINRA regulations establish guidelines for professional conduct, financial disclosure, and investor protection among registered brokers and brokerage firms. Adherence to these regulations promotes investor confidence, market stability, and fair practices within the financial services community.

How Jordan Meadow’s Case Compares to Other Broker Disputes

Jordan Meadow’s case is emblematic of broader issues surrounding ethics and compliance within the securities industry. Comparisons with other broker disputes underscore the varying nature of allegations, legal outcomes, and regulatory responses affecting professionals in the financial services sector.

Analyzing Meadow’s case in relation to similar disputes provides insights into regulatory trends, legal precedents, and investor protection measures. Investors, industry professionals, and regulatory authorities may draw lessons from these comparisons to enhance oversight, accountability, and ethical standards within the securities industry.

What’s Next for Jordan Meadow?

The future trajectory of Jordan Meadow’s career and legal standing hinges on the outcome of ongoing investigations and regulatory proceedings. The U.S. Securities and Exchange Commission (SEC) and other regulatory agencies are actively pursuing allegations of insider trading and securities violations against Meadow.

Potential outcomes for Meadow include legal sanctions, financial penalties, and restrictions on his activities within the securities industry. Investors, regulatory authorities, and legal experts are monitoring developments to assess the implications for market integrity, investor protection, and regulatory enforcement.

Jordan Meadow’s Legal Defense and Options

Jordan Meadow may pursue various legal defenses and options in response to allegations of insider trading and securities violations. Legal strategies may include challenging the allegations, negotiating settlements, or seeking to mitigate potential penalties and sanctions imposed by regulatory authorities.

Meadow’s legal defense will likely involve coordination with securities attorneys, financial experts, and regulatory compliance advisors. The objective is to protect Meadow’s professional reputation, minimize legal liabilities, and navigate the complexities of securities law and regulation effectively.

Conclusion

Jordan Meadow’s case underscores the importance of ethical conduct, regulatory compliance, and transparency within the financial services industry. The allegations of insider trading and securities violations highlight the potential consequences of misconduct for professionals and investors alike.

Lessons learned from Meadow’s case include the significance of due diligence, ethical decision-making, and adherence to legal standards in financial transactions. Regulatory oversight, investor education, and enforcement measures play pivotal roles in maintaining market integrity and safeguarding investor interests.